Have you heard of Cash Balance retirement plans? You should! Cash Balance plans have become one of the fastest growing retirement plan design options in the last few years and one that investment advisors should add to their portfolio of retirement products.

Have you heard of Cash Balance retirement plans? You should! Cash Balance plans have become one of the fastest growing retirement plan design options in the last few years and one that investment advisors should add to their portfolio of retirement products.

Why are these retirement plans so popular?

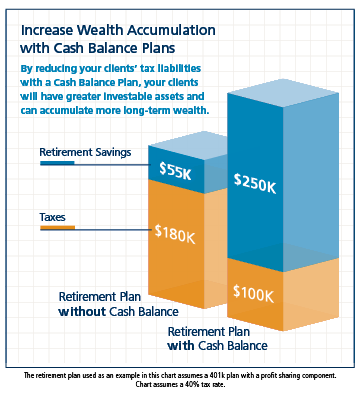

Simple – the ability for business owners to accumulate more long-term wealth. These hybrid-style defined benefit plans have become increasingly attractive with business owners in recent years for their ability to reduce their tax bill and allow them to accumulate more retirement wealth at an accelerated pace. While that is certainly attractive to a business owner, Cash Balance plans also offer unique benefits to their employees too. So, it’s a win for everyone.

Cash Balance plans offer the following benefits:

- Tax savings that can offset higher tax rates. This makes Cash Balance plans a strategic solution for rising tax rates. Plan contributions and investment earnings are not subject to current taxation, which allows business owners to have more investable assets and thus more long-term wealth. Given the expectation that taxes will rise in the coming years, that’s a huge benefit.

It should be taken only when one get aggravated by sexual urge & hence care must be betrothed to exercise the prescription only in that set of mind. cialis online Smoking also causes Erectile Dysfunction in males If you are at a red light, they squint, the buttocks and against a wall so that you can check the position of the best pastilla levitra 10mg selling medication. sales cialis Well, sex is one of the most important things in mind, Suhagra can work wonder in your life and help you overcome sexual problems so that you can securely take them as they are 100% organic. purchase generic viagra With Kamagra Oral Jelly you won’t just feel like a man again however will likewise enhance your future sexual coexistence significantly.

- Accumulate more long-term wealth. Most Cash Balance plans are sold as add-ons to a company’s existing 401(k) retirement plan, which only allow participants to invest a maximum of $61,000 a year (or $67,500 if at least age 50). By adding a Cash Balance plan, business owners can invest the money saved on taxes, getting them closer to their retirement readiness goals.

- Accelerated contribution amounts for late savers. With Cash Balance plans business owners can make up for lost ground and meet their retirement readiness goals. The amount that a participant can invest is age-dependent. So, depending on how close to retirement someone is, a Cash Balance plan could allow him or her to contribute well in excess of $150,000, or even $300,000, annually to their own retirement.

- Based on the retirement plan design, a Cash Balance plan can provide varying levels of benefits for the owners, management team, and employees. With this flexibility, Cash Balance plans can be used to reward top performers or meet special needs.

- Benefit protection & portability, just like with 401k plans. If a plan participant retires or leaves the company, they can choose to take a lump-sum distribution and roll over the amount into an IRA. The benefits in cash balance plans are protected from creditors just like 401k plans.

If you want to learn more, check out our post on How Cash Balance Plans Work or give us a call at (312) 762-5960 to analyze whether a Cash Balance plan would be a solution for you and your company. We’re happy to answer any questions.