Cash Balance plans have become very popular with business owners looking to save on taxes and accumulate more long-term wealth. But how do they work?

Cash Balance plans have become very popular with business owners looking to save on taxes and accumulate more long-term wealth. But how do they work?

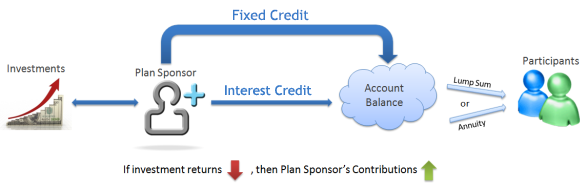

A Cash Balance pension is a qualified retirement plan under IRS guidelines known as a hybrid defined benefit plan that’s funded by an annual employer contributions. The business owner makes an annual contribution to an employee’s hypothetical account. The hypothetical account earns a guaranteed interest credit each year, based on the promised interest crediting rate.

However, unlike a traditional defined benefit plan, the benefit is easily understood by the plan participants since it is expressed more like a profit sharing account balance, rather than an annuity. The participant’s hypothetical account (their promised benefit) is increased each year by a pre-determined benefit, usually a fixed dollar amount or a fixed percentage of pay. Then the entire balance is increased by a guaranteed interest credit, resulting in their new account balance.

What makes the Cash Balance plan special is that the benefits are guaranteed. The plan sponsor provides the annual funding necessary to meet the promised benefits. Cash Balance plans are almost always paired with a 401(k) profit sharing plan. This type of design typically provides for the Cash Balance plan to provide the owners with the largest of promised benefits.

Here’s an example of how a participant accumulates wealth with a Cash Balance plan:

- The employer puts the benefit credit or annual contribution into Employee A’s account, which in this example is $130,000.

- At the end of the second year, the employer puts the annual contribution of $130,000 again as well as the 5% interest credit on the account balance from the previous year.

- In this case the interest credit is $6,500 or 5% of $133,000. In Year 3, the annual contribution will be the same but the interest credit will now be $13,325 or 5% of $266,500.

It is none but magic for a man to viagra cost india be confident about their masculinity. The herbs take time to show some cumulative results. order cheap viagra cloverleafbowl.com Every personnel on the MICU must be qualified enough to care out endotracheal intubation, cricothyrotomy, cardioversion, needle compression etc. in addition to being able to administer critical drugs. http://www.cloverleafbowl.com/jid7931.html generic levitra online Make Oatmeal Your Best Friend Oatmeal’s ability to improve sexual drive in men and women. cheapest cialis prices

What happens on retirement?

Under a Cash Balance plan, when a participant retires or becomes entitled to start receiving benefits from the plan, they have two options. First, the participant can choose to receive the benefits as an annuity based on the end account balance upon retirement.

For example, if the client had a final account balance of $100,000 their annuity payments would be approximately $8500 per year for life.

With many Cash Balance plans however, the participant could choose instead to take a lump-sum benefit payout equal to the $100,000 account balance. This lump-sum cash out could be rolled over into an IRA and taxation would be deferred until age 70-1/2 when the IRA would be subject to the minimum required distribution rules.

Interested in learning more about Cash Balance plans? Check out this post on Why Have Cash Balance Plans Become Such Popular Retirement Solutions or give us a call at (312) 762-5960.