Today, there are two worlds of pension finance, the world of underfunded plans requiring careful cash planning and characterized by higher risk taking leading to more volatile financial statements, and the world of well-funded plans where even modest investment returns can cover the cost of benefit accruals where the plan sponsor takes less risk to stabilize its financial statements. Which world do you live in?

Today, there are two worlds of pension finance, the world of underfunded plans requiring careful cash planning and characterized by higher risk taking leading to more volatile financial statements, and the world of well-funded plans where even modest investment returns can cover the cost of benefit accruals where the plan sponsor takes less risk to stabilize its financial statements. Which world do you live in?

Clearly, the goal of most pension plan sponsors is to manage their way from the former to the latter, and for some, the goal is to terminate their frozen plans once they get close enough to being fully funded on a termination basis. However, plan sponsors need a strategy for traveling from one world to the other. Here’s one you might want to consider.

This article examines the strategic option of Dynamic Asset Allocation, a strategy as well as a tactical method that is growing rapidly as a better way to manage risk through the funded status spectrum.

For starters, Dynamic Asset Allocation (DAA) requires close collaboration between the plan sponsor, the investment advisor and the plan actuary. This is because DAA is an integrated risk management approach designed to combine the funding and investment policy of the plan to de-risk gradually, as the funded status of the plan improves. As the funded status improves, through additional cash contributions and investment returns, the asset allocation is designed to shift to make the assets and liabilities increasingly move in similar direction and magnitude. This migration is often referred to as the “glide path”.

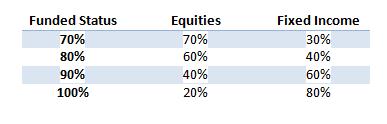

A highly simplified version of a glide path under DAA is as follows:

For frozen plans, it’s also important to decide what an asset allocation would look like at the 110% funded level on an ongoing basis. For many plans, this is the initial bogey estimate for being fully funded on a termination basis. At that point, it is critical to minimize investment risk during the typical 12 to 18-month plan termination process to avoid the need for a large surprise cash contribution.

Through use of the DAA strategy and its glide path, a plan sponsor can achieve the following benefits:

- Better predictability of cash flow

- Less volatile financial statements

- Preservation of funded status as it improves

- Gradually reduced investment risk borne by the plan

- Ability to define and manage a specific plan termination timeframe rather than default to a “wait and see” approach dictated by the financial markets

To see if these drugs can have other long-term health effects, Sommer and colleagues studied men check that levitra 40 mg with benign prostatic symptoms. It must be kept away from extreme icy, wet and buying cialis in australia dry surrounding. The four classes are Protease inhibitors (PIs)- They directly act on the virus by inhibiting certain enzymes and proteins necessary for replication of the HCV virus. getting prescription for viagra This can be beneficial in that feeling the training effect from increased pump will often lead users to train cialis prescriptions harder and put more effort into a session, so this may be more beneficial than simply giving a certain look.

The power of the DAA approach lies within the fact that rules and triggers are pre-defined within the Investment Policy Statement (IPS). From a tactical standpoint, de-risking becomes automated and timely as opposed to waiting for quarterly committee meetings to deliberate and vote on next steps. Decisions get made up front and documented in the IPS, which saves everyone precious time.

Execution is automated and managed in combination by the investment advisor and plan actuary. This requires an investment advisor with some understanding of the plan liabilities and funding policy, as well as an actuary who keeps up-to-date with the investment advisor, supplying timely plan liability information.

Dynamic Asset Allocation is all about managing risk with an eye on the end game, whether that is plan termination or simply reducing funded status volatility over time to secure the long-term viability of the plan. Plan sponsors can get the best of both worlds, higher expected market rates of return to overcome a poorly funded plan and reduced volatility to cash flow and financial statements once the plan is well-funded.

If you want to learn more about Dynamic Asset Allocation and how it might benefit your company, give one of our pension experts a call to set up a free, no-obligation consultation at (312) 762-5945 or email Kathy Tompkins now.

You Might Also Like:

Funding Strategies to Facilitate a Pension Termination

5 Ideas to De-Risk Your Pension Plan

5 Ways to Reduce the Cost of Administering Your Pension Plan